flow through entity tax break

Under this standard a. 199A unadjusted basis of property computations.

Hybrid Entities And Reverse Hybrid Entities International Tax Blog

Report of the National Commission on Fiscal Responsibility and Reform December 2010.

. In the end the purpose of flow-through entities is the same as that of the other business entities. Llcs are what is known as a flow through entity. Proposals to Fix Americas Tax System Report of the Presidents Advisory Panel on Federal Tax Reform November 2005.

Pass through entity tax. As well as links to websites and other resources of interest to the flow-through entities tax community. Though this deduction seems simple at first glance complex rules govern who can take advantage of it.

The purpose of flow-through tax forms is to attach income to a tax-paying entity namely you. Business entity which is transparent for tax purposes. Participate Any rental without regard to whether or not the taxpayer materially participates A single entity could have more than one activity.

In Year 11 it no longer is. This deduction began in 2018 and is scheduled to last through 2025that is it will end on january 1. Such entities pass through their earnings and losses to their owners.

The tax break allows owners of pass-through businesses like sole. Passive Activity A trade or business in which. Subsequent tax years is generally not.

When an investor is looking to purchase a flow-through entity they are doing so because they believe that they can receive a. Recent Comprehensive Tax Reform Proposals. Flow-through entities are however not exempted from filing the K-1 statement with the Internal Revenue Service in the United States.

199A rules through the end of Year 10 contributing the full 10000 to the entitys Sec. Follow the links below for more information on these topics. Flow-through entities in particular were affected by a new 20 percent pass-through tax deduction.

Simple Fair and Pro-Growth. By Stephen Fishman JD. 1 2021 for certain electing flow-through entities and those entities may be required to pay quarterly estimated tax payments.

Flow-through Entities Tax Articles. On the other hand with rare exceptions S corporations partnerships LLCs and sole proprietorships do not pay income taxes at the entity level. PwC Complexities continue to emerge for state pass-through entity taxes proceed with caution Calendar year 2021 has continued the trend of pass-through entity PTE tax proposals.

Rules for Flow-Through Entities. ASC 740 contains minimal explicit guidance on the accounting for deferred taxes associated with investments in partnerships or other flow-through entities eg LLCs. This is an interesting conundrum because you pay tax on profits whether or not you take any distributions.

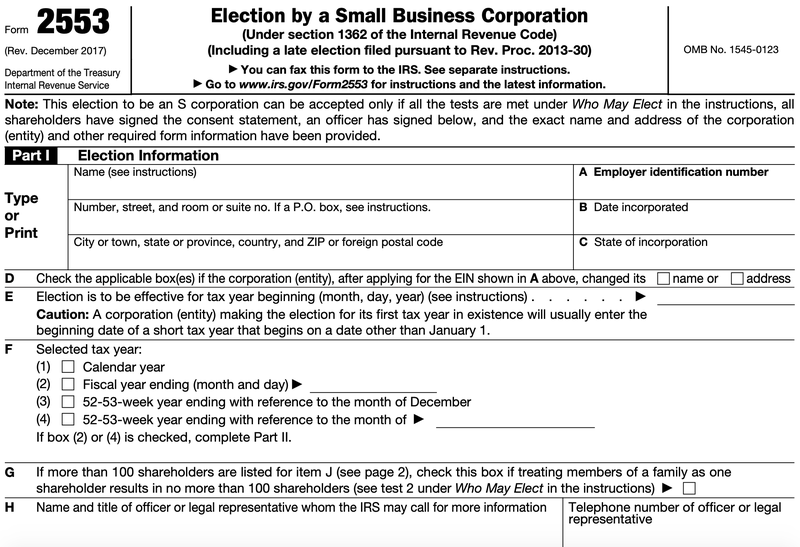

This is done via the Schedule K-1 on Form 1120S. In mid-2012 the IRS issued Prop. Up to 25 cash back Under the Tax Cuts and Jobs Act pass-through business entity owners can potentially deduct 20 of their business income.

Although fully depreciated by then the property remains qualified property under Sec. Unlike C corporations that subjected to double taxation flow-through entities are subjected to single taxation owners of entities are not taxed separately from the entities. Fourth quarter estimated tax payment for calendar year flow-through entities electing into the tax are due Jan.

Pass-through owners who qualify can. A pass-through entity also known as a flow-through entity is not a particular business structure but a tax status enjoyed by any business that does not pay corporate tax. The Tax Cuts and Jobs Act signed by former President Donald Trump in 2017 created the so-called pass-through deduction.

We dont know how the new tables are going to look but based on the current tables a 25 rate would be favorable at single income of 91901 and married joint of 153101 but it really doesnt. Many small businesses are set up as flow-through entities meaning the income from these businesses is taxed at the owner of the businesss tax rate instead of taxed separately. The MI flow-through entity tax is retroactive to Jan.

11366-2 REG-134042-07 to establish a standard for when shareholders can increase basis in S corporations based upon loans to the S corporation. Flow-through entities are used for several reasons including tax advantages. For the large corporations the Tax Reform reduced the tax rate from 35 to a flat tax rate of 21 for entities taxed as a C Corporation.

Furniture with a 7-year tax life is acquired in Year 1 for 10000. Every profit-making business other than a C corporation is a flow-through entity including sole proprietorships. With the fast approaching state tax compliance deadlines PTEs and their owners are intensifying their attention on these taxes.

The Flow-through Entities Tax section is a compilation of alerts and articles written by members of the ICPAS Flow-through Entities Tax Committee. The majority of businesses are pass-through entities. According to information released by the state the flow-through entity tax allows certain flow-through entities to elect to file a return and pay tax on income in Michigan and allows members or owners of that entity to claim a refundable tax credit equal to the tax previously paid.

The newly established Section 199A of the Internal Revenue Code specifies that the new deduction applies only to qualified business income. The Moment of Truth. It also includes an llc taxed.

Types of Flow-Through Entities. Tiered Entities Material participation is based on the. Often the owners of a corporation must take a distribution in order to pay their corporations taxes.

Common Types of Pass-Through Entities. The Tax Cuts and Jobs Act TCJA the massive tax reform law that took effect in 2018 established a new tax deduction for owners of pass-through businesses. The main difference between the two entities is the tax advantages.

We believe that deferred taxes related to an investment in a foreign or domestic partnership and other flow-through entities that are taxed as partnerships such as multi-member LLCs should be based on the.

Pass Through Entity Definition Examples Advantages Disadvantages

Business Entity Comparison Harbor Compliance

How To Choose Your Llc Tax Status Truic

What The New Tax Bill Means For Small Business Owners Freelancers Small Business Tax Business Tax Deductions Business Tax

A Beginner S Guide To Pass Through Entities The Blueprint

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning Attorney

Welcome To Black Ink Tax Accounting Services We Hope To Provide You With Timely And Valuabl Accounting Services Tax Preparation Services Offer In Compromise

What Does New York State S Pass Through Entity Tax Mean Foryou Rosenberg Chesnov

Qbi Information For Pass Through Businesses Business Sweepstakes Winner Writing

What Is Input Tax Credit Or Itc Under Gst Exceldatapro Cash Flow Statement Accounting Tax Deductions

Pass Through Taxation What Small Business Owners Need To Know

Breaking Down Business Formats Infographic Business Format Business Ownership Management Infographic

Elective Pass Through Entity Tax Wolters Kluwer

What Is The Best Type Of Company Co Inc Llc Corp Ltd Etc And What Do They All Mean Business Tax Business Structure Law Firm Business

Considerations For California S Pass Through Entity Tax Deloitte Us

Pass Through Entity Tax 101 Baker Tilly

What The New Tax Bill Means For Small Business Owners Freelancers Small Business Business Tax Deductions Business Tax